Ahead of the Alibaba Smart Car Spinoff, How Should You Play BABA Stock?

/Alibaba%20by%20testing%20via%20Shutterstock.jpg)

Alibaba Group (BABA) is a Chinese multinational technology company that specializes in e-commerce, retail, and cloud computing. The company operates leading marketplaces including Taobao (C2C), Tmall (B2C), and Alibaba.com (B2B). Alibaba has evolved into a diversified tech giant with strong investments in artificial intelligence (AI), digital media, logistics through its Cainiao network, and fintech via Ant Group. After years of regulatory and market uncertainty, Alibaba has finally been making a comeback.

Founded in 1999, the company is headquartered in Hangzhou, China.

About BABA Stock

BABA stock has shown plenty of volatility this year, with a couple of major movements. The stock is up over 45% year-to-date, outpacing the illustrious S&P 500’s ($SPX) 9% increase. Despite the solid gains, the stock has been trading flat since April, with only a 2% gain in a month and 1.2% in a quarter. Overall, Alibaba still has room to grow, with the stock being 17% below its 52-week-high set in March this year.

Alibaba Posts Mixed Results

Alibaba Group reported its second quarter 2025 financial results with adjusted earnings per share of $2.15, slightly below the prior year and analyst estimates, reflecting a minor 4% decline year-over-year (YOY). Revenue for the quarter rose 5% YOY to $33.7 billion, beating expectations and driven largely by growth in the Cloud Intelligence Group and international e-commerce segments.

Other key financial metrics included a 58% surge in net income to $6.25 billion and strong performance in Alibaba Cloud, which grew 7% in revenue with an 89% jump in adjusted EBITDA, fueled by AI product adoption. However, segments like Cainiao logistics and Alibaba International Digital Commerce showed profitability pressures.

Looking ahead, Alibaba remains focused on accelerating its AI and cloud investments, committing $53 billion over three years to AI infrastructure. Management expects continued growth from AI-powered services and expanding international markets but cautions about regulatory risks and geopolitical uncertainties in 2025 affecting margins and overall profitability.

Alibaba-Backed Company Eyes IPO

Alibaba-backed Banma, a Shanghai-based technology provider specializing in smart cockpit solutions for vehicles, is preparing to potentially list its shares on the Hong Kong Stock Exchange, according to a recent filing dated Aug. 21. Alibaba currently holds about 45% ownership in Banma and plans to retain control of over 30% following the proposed listing. However, the filing also cautions that this announcement does not guarantee that the listing will definitely occur.

Founded in 2015, Banma develops innovative smart cockpit solutions that integrate artificial intelligence into automotive systems. In March, Alibaba announced that it was deepening its collaboration with BMW (BMWKY) in China by developing an AI engine for cars, built using Banma’s intelligent cockpit technology. The venture underscores Alibaba’s strategic focus on integrating AI and digital technologies within the automotive sector.

Besides Alibaba, Banma’s investors include prominent Chinese firms such as SAIC Motor, SDIC Investment Management, and Yunfeng Capital, the latter being an investment company established by Alibaba co-founder Jack Ma.

Alibaba has previously described Banma as a joint venture formed between itself and SAIC Motor, highlighting the close partnership aimed at advancing connected car technologies in China’s expanding smart vehicle market. The potential public listing is a significant step for Banma as it aims to accelerate growth and innovation in the smart car technology space.

Should you buy Alibaba?

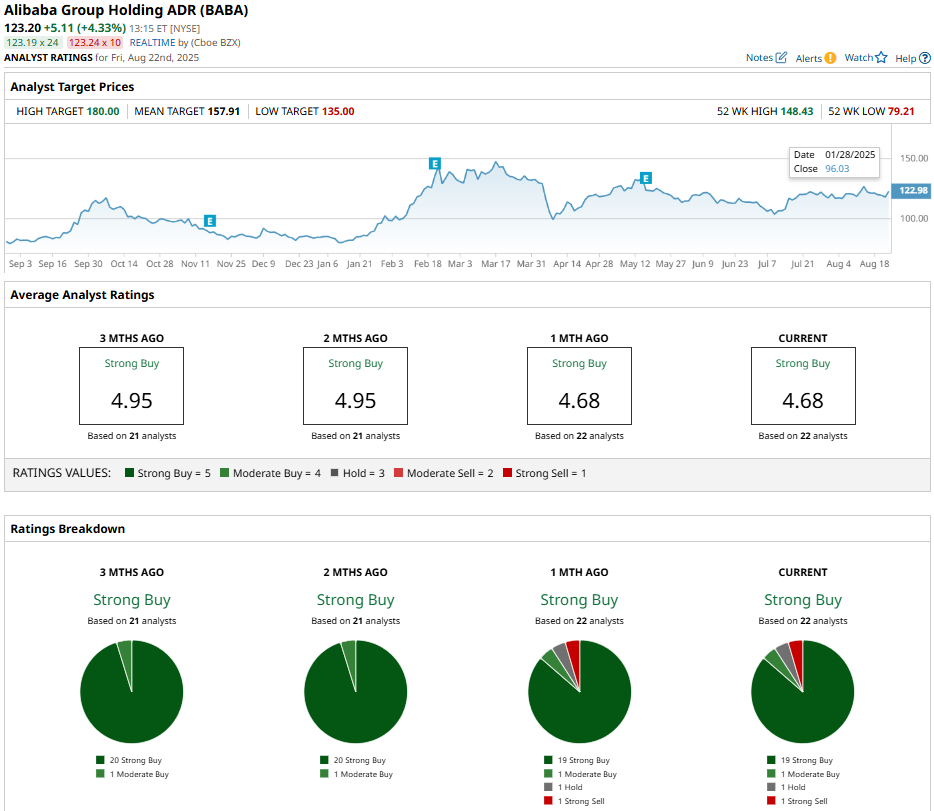

Analysts have a soft spot for the e-commerce giant, with a consensus “Buy” rating alongside a mean price target of $157.91, reflecting an upside potential of 28% from the market trading rate.

The stock has been studied by 22 analysts in total and has received 19 “Strong Buy” ratings, one “Moderate Buy” rating, 1one “Hold” rating, and one “Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.